One important way that Colorado has changed in recent years—and will continue to transform in the future—is in the overall makeup of our population. While nationwide the period from 2030 to 2050 is expected to be the slowest growth rate in our country’s history, Colorado has experienced strong population growth, with Denver alone growing by about 82,000 people between 2010 and 2015. By some estimates, the state could grow by another 2.3 million residents by 2040.

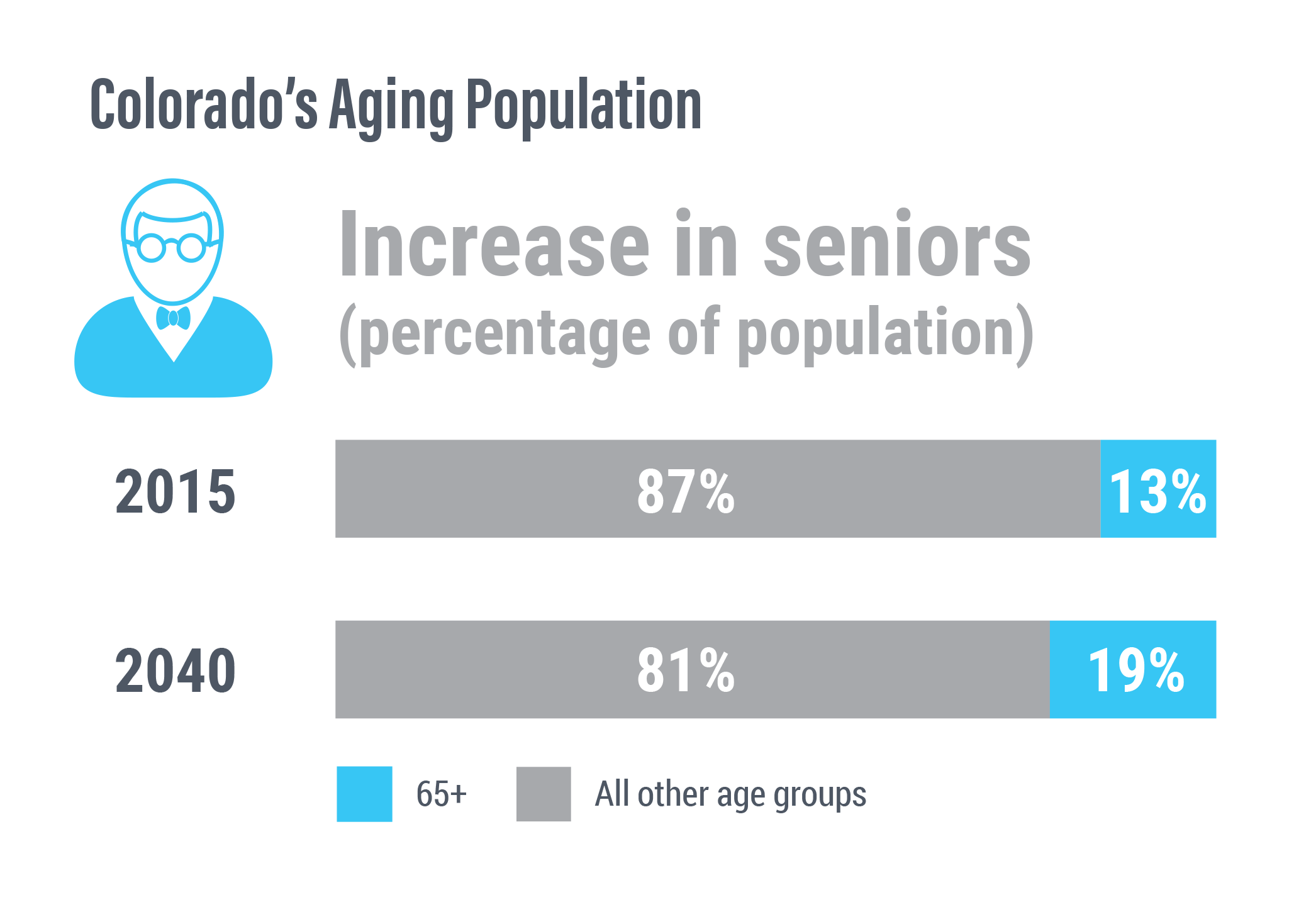

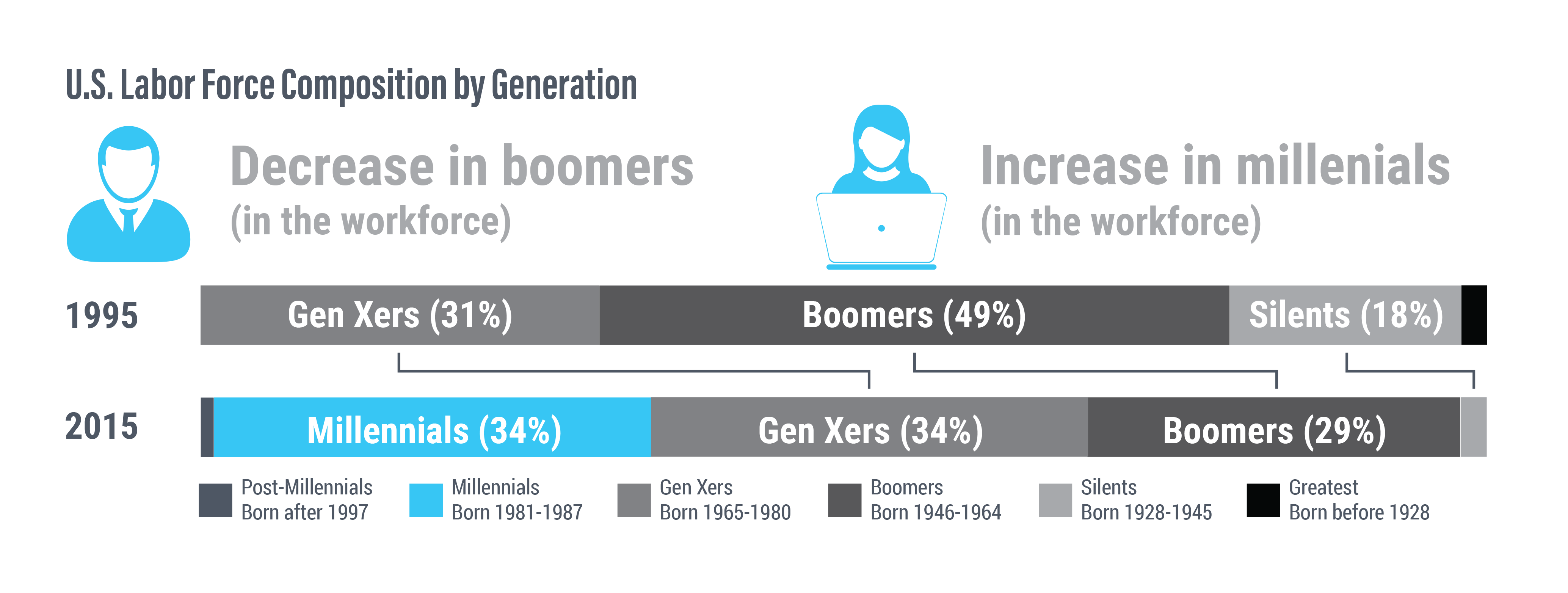

Both nationally and in Colorado, the population of seniors and the diverse “millennial” generation is on the rise. Both groups bring certain attitudes and expectations about how and where they want to live and work—for example, smaller households, fewer cars, and more walkable neighborhoods. Just as planners use demographic data to drive planning and zoning decisions, preservationists are exploring how historic resources can meet the needs of these growing populations.

Seniors and Millennials

Demographers predict that the 65+ cohort is expected to increase from 555,000 to 1,250,000 by 2040. Creating opportunities and conditions for older adults to continue to live in their community as they age helps support both their quality of life and also broader community revitalization. Historic buildings tend to be located in walkable areas containing a high concentration of the amenities and services that seniors desire, such as senior centers, health care services, grocery stores, and cultural facilities. Incentives encourage housing developers to repurpose historic properties for senior housing and services, along with upgrades to support accessibility and mobility. Historic preservation tax credits can be combined with other state and federal programs, such as Low Income Housing Tax Credits, in order to further reduce capital costs while providing afforable housing options.

Millennials are another important force driving demographic changes in Colorado. The state continues to attract young professionals, born between 1980 and 1995, as our economy shifts towards creative and technology-based industries. As millennials seek out unique spaces, historic buildings have naturally risen to the top of the list of “hip” places. Repurposed buildings host a range of new uses—from senior centers, to brewpubs, recording studios, and restaurants—and are specifically selected and valued for their historic qualities. Historic preservation and adaptive reuse are now important strategies for communities looking to attract youthful populations who desire to live, work, and play in neighborhoods with unique historic character.

Overall, there is a decrease in baby boomers and an increase in millennials in the work force.

Overall, there is a decrease in baby boomers and an increase in millennials in the work force.

Affordable Housing

While the revitalization of historic districts and neighborhoods is almost always a net-positive benefit for communities, there is often justifiable concern that growth and redevelopment may lead to gentrification, or the displacement of low-income residents. Housing affordability continues to be of growing concern in many places across the state, as many local economies thrive.

Recent Colorado examples show how the preservation of historic resources can be a strong partner in the development of affordable housing. Older buildings are often located in walkable, central neighborhoods that provide convenient access to residents who may not have cars. Private developers often combine incentives, such as the Low Income Housing Tax Credit (LIHTC), with state and federal preservation tax credits to finance projects that add to a community’s stock of affordable housing while also preserving historic resources. For instance, in 2013, over $1.2 million of the $6.4 million awarded by the state through the LIHTC went to affordable housing projects in historic buildings. Two examples from Fort Collins and Leadville are shown on these pages. In 2014, the state rehabilitation tax credit program was revamped and reauthorized by the legislature, in part to help ensure the development of affordable housing throughout the state, especially when federal funding is competitive and unpredictable. Historic preservation should not be overlooked as a critical component for encouraging the creation of affordable housing.